Correct a 401(k) Plan

by Admin

Posted on 01-07-2023 12:29 PM

Almost 40 percent of 401(k) plan participants do not fully understand and have difficulty using the fee information that the department of labor (dol) requires plans to provide to participants in fee disclosures, according to gao's analysis of its generalizable survey (see figure). Gao assessed participants' understanding of samples from several large plans' fee disclosures and other information about fees, and asked general knowledge questions about fees. For example, gao found that 45 percent of participants are not able to use the information given in disclosures to determine the cost of their investment fee.

Additionally, 41 percent of participants incorrectly believe that they do not pay any 401(k) plan fees.

Additionally, 41 percent of participants incorrectly believe that they do not pay any 401(k) plan fees.

Terminate a 401(k) Plan

Although you typically can withdraw from a 401(k) without penalty after age 59½, there is the “age 55” rule which allows you to withdraw from your 401(k) without penalty if you leave your job, or even if you’re laid off, terminated, or quit between the ages of 55 and 59½.

If you’re a public safety worker, the rule applies at age 50 or later. Plan strategically for taking withdrawals from your account — both to manage the tax bill and to provide for your future needs. For guidance, visit realizeretirement™ or contact your missionsquare retirement representative.

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras

If you’re a public safety worker, the rule applies at age 50 or later. Plan strategically for taking withdrawals from your account — both to manage the tax bill and to provide for your future needs. For guidance, visit realizeretirement™ or contact your missionsquare retirement representative.

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras

What should you do with the funds in these 401(k)s after you terminate employment? you may have up to four options: take a distribution. If you take a distribution, you will have to pay income taxes generally on the amount of the distribution and may have to pay an early withdrawal penalty. Do nothing. In most cases, you can keep the 401(k)s with your previous employers. However, some companies may require you to take your money out of their plan in order to reduce their administrative costs. Roll the funds into your current employer’s plan, if one is offered. A potential benefit of rolling the funds into another 401(k) plan is that your employer may pay a percentage of the plan’s annual fees.

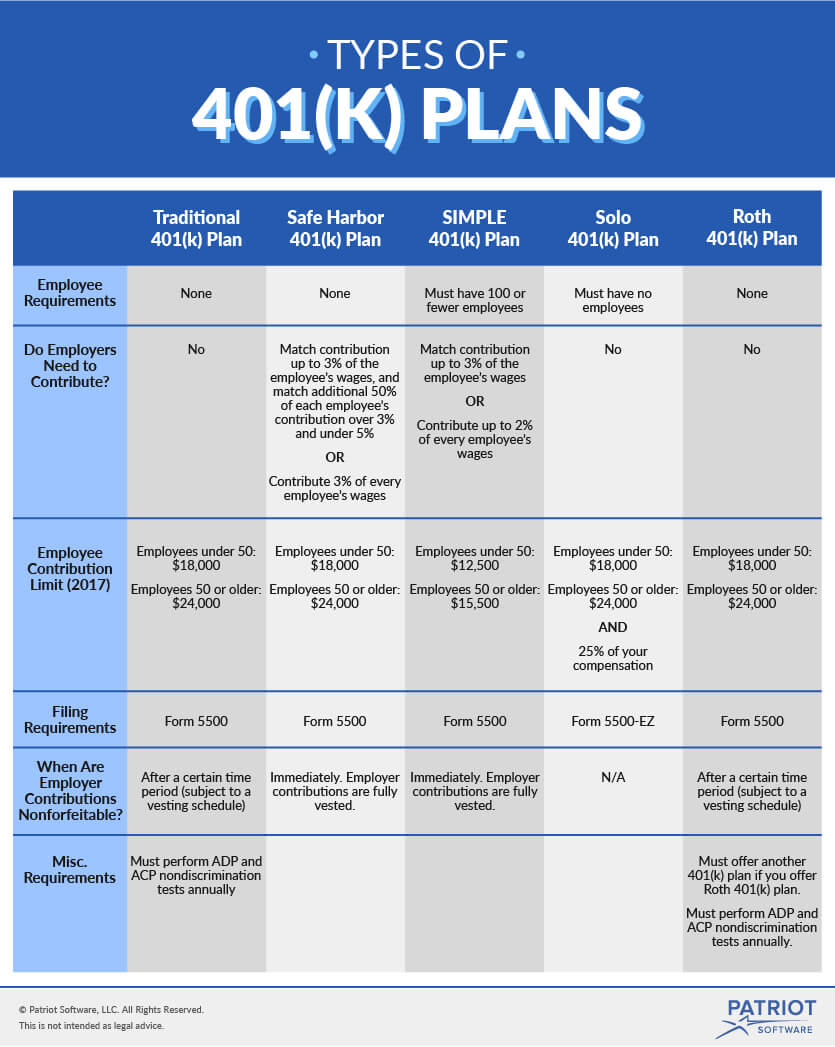

Once your solo 401(k) plan exceeds $250,000 in assets at the end of the year, the irs requires you file an annual form 5500 ez. Or if you ever terminate the plan, you must also file a form 5500 ez. Unlike traditional 401(k) plans, there are no compliance testing requirements to ensure solo 401(k) plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan. These plans can be called self-directed 401(k), individual 401(k), individual roth 401(k), self-employed 401(k), personal 401(k) or one-participant 401(k) depending upon the vendor offering the plan services.

Additional resources for 401(k) Plans

Each employee participating in the plan determines how much money is to be automatically contributed from each paycheck. Generally, participants can invest an annual maximum of $22,500 in 2023, or $30,000 for those 50 or older. Traditional contributions are made before taxes are deducted, which means that income taxes are not paid at the time of investment. Instead, taxes on both contributions and earnings are paid when the money is withdrawn. Plans may allow roth contributions, which are made with money that has been taxed. Money that’s been taxed won’t be taxed again. Additionally, earnings are tax- and penalty-free for qualified distributions.

There are many different financial plans that can help you save for a comfortable retirement. However, since all retirement plans have their own features and benefits, it's not always easy to know which one is which. That's why it's best to compare as many different plans as possible in order to make the right choice for you. So what are pensions plans and 401(k)s, and what are the key differences between the two? pension plans are defined benefit plans that can offer a great deal of security, providing lifetime income throughout retirement. However, these plans are increasingly rare and mostly found in government agencies.

401(k) accounts often offer a small, curated selection of mutual funds. That’s a good thing and a bad thing: on the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing. The downside is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what you’d pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio. Some plans also charge administrative fees on top of fund expenses, which can add up and compound over time, effectively reducing your overall investment return.

Any assets under management of vanguard personal advisor services. Vanguard mutual funds and vanguard etfs held by a client in certain personal accounts qualify. Personal account types include: individual non-retirement, education savings accounts, iras, joint, trust, custodian, guardian, utma, ugma, estate, sole proprietorship, and single-participant sep ira plans. Note: vanguard assets in a vanguard 529 plan, vanguard variable annuity, multi-participant sep ira plans, simple, i401k, 403(b), family partnership, family corporation, or employer-sponsored retirement plans for which vanguard provides recordkeeping services may be included in determining eligibility if you also have a personal account holding vanguard mutual funds or vanguard etfs.

Since congress created 401(k) plans in 1978, they have become the most popular retirement account in the u. S. One-third of workers had a 401(k)-style account in 2020, roughly double the number with an individual retirement account and triple those with a pension. While 401(k)s started as a way to build wealth for retirement, they are increasingly being used by retirees to manage their life savings. “more and more retirees are interested in staying connected with former employers whom they trust,” says tom armstrong, vice president of customer analytics and insight at voya financial in walpole, mass. Armstrong says that thanks to large-group pricing, keeping your money in the old 401(k) could help you qualify for lower investment fees than if you invested on your own by transferring the balance to an ira.

The employee retirement income security act (erisa) covers two types of retirement plans: defined benefit plans and defined contribution plans. A defined benefit plan promises a specified monthly benefit at retirement. The plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement. Or, more commonly, it may calculate a benefit through a plan formula that considers such factors as salary and service - for example, 1 percent of average salary for the last 5 years of employment for every year of service with an employer. The benefits in most traditional defined benefit plans are protected, within certain limitations, by federal insurance provided through the pension benefit guaranty corporation (pbgc).